An overview of the tax advantages of e-mobility

Electric vehicles continue to grow in popularity. And there is a reason for that: In addition to lower maintenance and operating costs, there is also a reduction in taxes for most cantons. This constitutes an important contribution to climate protection; after all, the combustion of conventional fuels produces gases that are harmful to the climate. On the other hand, E-mobility offers the opportunity for a much more energy-efficient and climate-friendly transport.

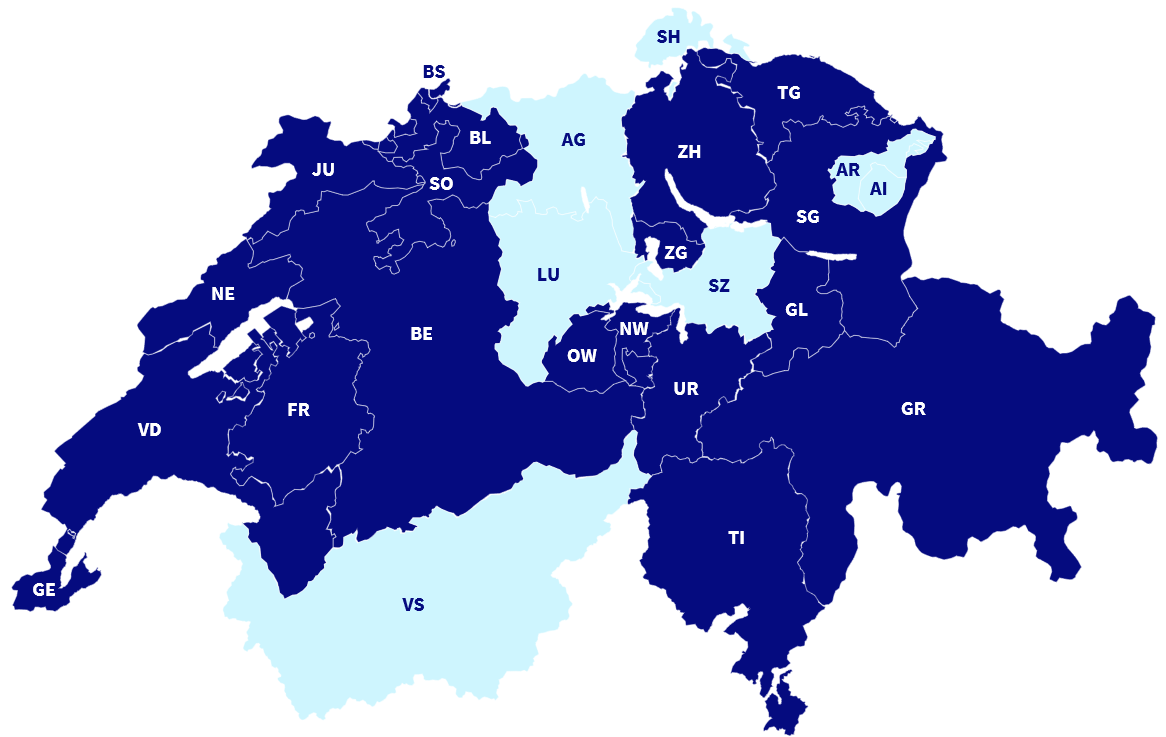

Since tax breaks for electric cars vary from region to region, we compiled a summary for each canton for your convenience. The chart gives you an overview of which cantons offer benefits. You will then find more detailed information on the regulations for the cantons in alphabetical order.

(Updated version 09/2023)

Tax bonus available in the following cantons:

Bern, Basel-Landschaft, Basel-Stadt, Fribourg, Geneva, Glarus, Grisons, Jura, Neuchâtel, Nidwalden, Obwalden, St. Gallen, Solothurn, Ticino, Thurgau, Uri, Vaud, Zug, Zurich

No tax bonus available in the following cantons:

Aargau, Appenzell I.-Rh., Appenzell A.-Rh., Lucerne, Schaffhausen, Schwyz, Valais

Aargau

No tax bonus available. When calculating the annual tax, the "tax horsepower" is the decisive factor. For the calculation of the tax horsepower, the 30-minute power of the vehicle in kW as per the manufacturer is calculated with the factor 0.1.

Example: 100kw x 0.1 = 10 tax hp = motor vehicle tax CHF 300

More information

Appenzell Innerrhoden

Tax bonus only available upon prescription. As a rule, every motor vehicle is subject to tax, depending on its total weight. For the first 1'000 kg a tax of CHF 200 is due. After that, the tax is CHF 3 per additional 10 kg.

More information

Appenzell Ausserrhoden

No tax bonus available The annual tax is based on the total weight of the vehicle.

Up to 500 kg a tax of CHF 142 is due. For the following 1,000 kg total weight, CHF 2.85 is added for each additional 10 kg or part thereof. In addition, CHF 3.35 will be charged for each additional 10 kg or part thereof.

More information

Bern

Tax bonus available. The annual tax for electric vehicles is CHF 0.12 per kilogram for the first 1,000 kg. For each additional tonne, this tax is reduced by 14% of the preceding tax rate.

From their first placing on the roads, vehicles with exclusively electric battery drive benefit from a 60% reduction on the normal tax for the current and the following three years.

More information

Basel-Landschaft

Tax bonus available. The annual motor vehicle tax is CHF 0.28018 per kg of total weight. For private cars that emit less than 120 g of CO2 per km when first placed on the roads, a tax reduction of up to CHF 300 is granted for the year in which the car is first placed on the roads and for the following three years.

More information

Basel-Stadt

Tax bonus available The annual tax is based on the total weight (CHF 1.25 per 10 kg) and the CO2 emissions (CHF 1.60 per g/CO2). All-electric vehicles receive a tax rebate of 50% for a maximum period of 10 years, as long as the vehicle population of these private vehicles in Basel-Stadt is less than 5%. The population is decisive on 30 June of each year.

More information

The purchase of an electrically powered commercial vehicle is subsidised with 20 % of the net purchase price or a maximum of CHF 7,000. E-passenger cars are not eligible.

More information

Freiburg

Tax bonus available. The motor vehicle tax is based on the power in kW. Electric vehicles and vehicles with energy label "A" are each granted a 30 % discount. These are cumulative.

More information

Geneva

Tax bonus available. New vehicles are exempt from transport taxes for the first three years. After that, you pay half the normal levies.

More information

Glarus

Tax bonus available. Vehicles with an all-electric drive are exempt from transport tax.

More information

Grisons

Tax bonus available. Transport tax is reduced by 80% for light motor vehicles with maximum CO2 emissions of 110 g/km (according to WLTP). Tax is calculated based on the total weight.

More information

Jura

Tax bonus available. Only half of the transport fees are payable. Tax is calculated based on the total weight.

More information

Lucerne

Tax bonus available. The tax payable is based on the performance of the vehicle. For the first 75 kW there is a tax of CHF 0.075 each. For the next 75 kW it is CHF 0.065. Beyond that, an amount of CHF 0.055 is due for each additional kW. For electric vehicles, 80% of the total amount is payable as tax.

More information

Neuchâtel / Neuchatel

Tax bonus available. Electric vehicles only pay the fixed part of CHF 250 of the annual tax. The share of CO2 emissions, which is added to conventional vehicles, does not apply.

More information

Nidwalden

Tax bonus available. Vehicles that are assigned to the best efficiency category as per the energy label at the time they are first placed on the road are exempt from transport tax for the first three years. The total weight of the vehicle is used to calculate the tax and amounts to CHF 200 up to 1'000 kg, CHF 12 per 100 kg up to 2'500 kg and CHF 10 per 100 kg up to 16'000 kg.

More information

Obwalden

Tax bonus available. Passenger cars that are classified in the best efficiency category according to the energy label when they are first put on the road are exempt from 50% of the transport tax for the first two years.

More information

St. Gallen

Tax bonus available. Electric vehicles are exempt from tax at 100% in the year they are put on the road and for the three following years, and at 50% thereafter. The tax rate is based on the total weight of the vehicle. It amounts to CHF 0.26 per kilogram.

More information

Schaffhausen

No tax bonus available. EVs up to 30 kW pay an annual tax of CHF 120. Each additional full or fractional 5 kW incurs an additional CHF 3.

More information

Solothurn

Tax bonus available. Vehicles with an all-electric drive are exempt from transport tax.

More information

Schwyz

No tax bonus available. The motor vehicle tax is calculated as follows:

(Power 0.9 / Total weight 0.05) * Tax index

The tax index is currently 7.125.

More information

Tessin / Ticino

Tax bonus available. A flat-rate premium of CHF 4'000 is granted for the purchase of purely electric cars, and a premium of CHF 2'000 for hybrid vehicles, .

A lump sum of CHF 500 is granted for the installation of a charging station for electric cars, and CHF 4'000 for a bidirectional charging station.

More information

Thurgau

Tax bonus available. Vehicles with an electric drive pay 50% of the annual tax in the year of placing on the road and the following four years.

More information

The canton of Thurgau is encouraging the purchase of electric cars with a premium of CHF 2,000.

More information

Uri

Tax bonus available. The standard tax is reduced to two thirds for battery-powered vehicles. The tax is based on the total weight. Up to 1'500 kg tax is CHF 1.80 per 10 kg. Up to 2,000 kg tax is CHF 2 per 10 kg and over 2,000 kg tax is CHF 2.20 per 10 kg.

More Information

Waadt /Vaud

Tax bonus available. The traffic tax for electric vehicles is CHF 25 per year.

More information

Wallis

No tax bonus available. Vehicles with electric drive are taxed at CHF 90 for vehicles up to 10 kW. CHF 23 will be charged for each additional 30 kW or fraction thereof. A tax of CHF 160 is payable for more than 70 kW.

More information

Zug

Tax bonus available. A reduced annual tax of 50% is levied. The normal annual tax is calculated based on the total weight and is charged at CHF 200 for vehicles weighing up to 1,000 kg. Up to 2,500 kg, the tax increases by CHF 20 per 100 kg. Beyond that, an amount of CHF 10 per 100 kg is due.

More information

Zurich

Tax bonus available. No traffic tax needs to be paid for vehicles with an all-electric drive.

More information

(Status Sept. 2023)